In today’s fast-paced world, financial flexibility is more crucial than ever. Whether you’re planning a home renovation, funding your education, or managing unexpected expenses, having access to quick and reliable loans can make all the difference. This is where “enable loan apps” come into play, offering a seamless and efficient way to secure the funds you need.

What Are Enable Loan Apps?

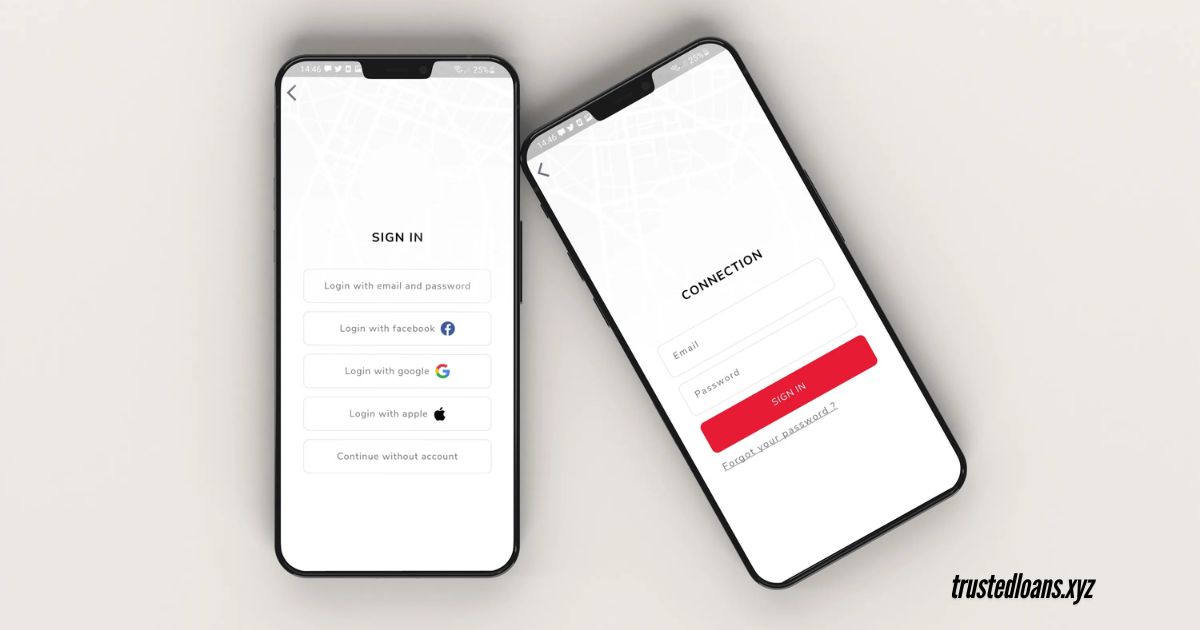

Enable loan apps are digital platforms designed to simplify the loan application process. They allow users to apply for personal loans directly from their smartphones or computers, eliminating the need for lengthy paperwork and in-person visits to financial institutions. These apps provide a user-friendly interface, enabling borrowers to complete applications in minutes, receive instant approvals, and access funds promptly.

Key Features of Enable Loan Apps

- User-Friendly Interface: Designed for ease of use, these apps guide users through the loan application process with clear instructions and intuitive navigation.

- Quick Approval Process: With automated systems, loan approvals are expedited, often within minutes, allowing borrowers to access funds without unnecessary delays.

- Flexible Loan Amounts and Terms: Borrowers can choose loan amounts and repayment terms that align with their financial situation, providing greater flexibility.

- Secure Transactions: Advanced encryption and security measures ensure that personal and financial information remains protected throughout the loan process.

- 24/7 Accessibility: Access the app anytime, anywhere, making it convenient to apply for loans as per your schedule.

Advantages of Using Enable Loan Apps

- Convenience: Apply for loans from the comfort of your home or on the go, without the need to visit a bank.

- Speed: Receive quick approvals and access to funds, helping you address urgent financial needs promptly.

- Transparency: Clear terms and conditions with no hidden fees, ensuring you understand your repayment obligations.

- Credit Building: Responsible use of these loans can help improve your credit score over time.

Comparative Analysis: Top Enable Loan Apps

To assist you in choosing the right enable loan app, here’s a comparison of some leading platforms:

| Feature | App A | App B | App C |

|---|---|---|---|

| Loan Amount | $500 – $5,000 | $200 – $10,000 | $1,000 – $15,000 |

| Interest Rate | 5% – 15% | 6%-12%. | 4% – 14% |

| Repayment Term | 6–24 months | 3 – 36 months | 12 to 48 months |

| Approval Time | Instant | Within 24 hours | Within 48 hours |

| Credit Score Requirement | 600+ | 650+ | 700+ |

| Additional Features | Flexible repayment options | No prepayment penalties | Rewards program for timely payments |

Note: The above table is for illustrative purposes. Actual terms may vary based on the lender and your credit profile.

User Experience: A Personal Touch

Imagine Sarah, a young professional in Faisalabad, who needs funds to pursue a career development course. With an enable loan app, she applies for a loan of $1,000 directly from her smartphone. Within minutes, she receives approval, and the funds are deposited into her account, enabling her to enroll in the course without delay. This seamless experience empowers Sarah to invest in her future without the traditional hurdles of loan applications.

Actionable Tips for Using Enable Loan Apps

- Assess Your Financial Needs: Determine the exact amount you need to borrow and ensure it aligns with your repayment capacity.

- Compare Different Apps: Evaluate various loan apps based on interest rates, repayment terms, and user reviews to find the best fit for you.

- Check Eligibility Criteria: Ensure you meet the minimum credit score and income requirements set by the app.

- Read Terms and Conditions Carefully: Understand the loan terms, including interest rates, fees, and repayment schedules, to avoid surprises.

- Maintain a Good Credit Score: A higher credit score can help you secure better loan terms and lower interest rates.

Conclusion

Enable Loan has revolutionized the way we access financial assistance, offering a convenient, fast, and secure alternative to traditional loan processes. By understanding their features, advantages, and how to use them effectively, you can make informed decisions that align with your financial goals. Remember, while these apps provide quick solutions, it’s crucial to borrow responsibly and ensure that any loan you take on is manageable within your budget.

Final Thoughts

Taking control of your financial future is empowering. With the right tools and knowledge, you can navigate life’s challenges with confidence. Share this article with friends and family who might benefit from understanding enable loan apps, and let’s embark on a journey toward financial freedom together. Your future self will thank you.