Imagine driving a car that feels like freedom—not just because it gets you places, but because it’s entirely yours. Paying off your auto loan early can transform that dream into reality. But is it the right choice for you? Understanding how to calculate early payoff savings is essential to making informed decisions.

In this article, we’ll explore how an auto loan early payoff calculator can be your ultimate tool for financial clarity. You’ll learn actionable tips, see real-world examples, and uncover the advantages of early payoff. By the end, you’ll be empowered to take control of your loan and save money. Let’s dive in!

What is an Auto Loan Early Payoff Calculator?

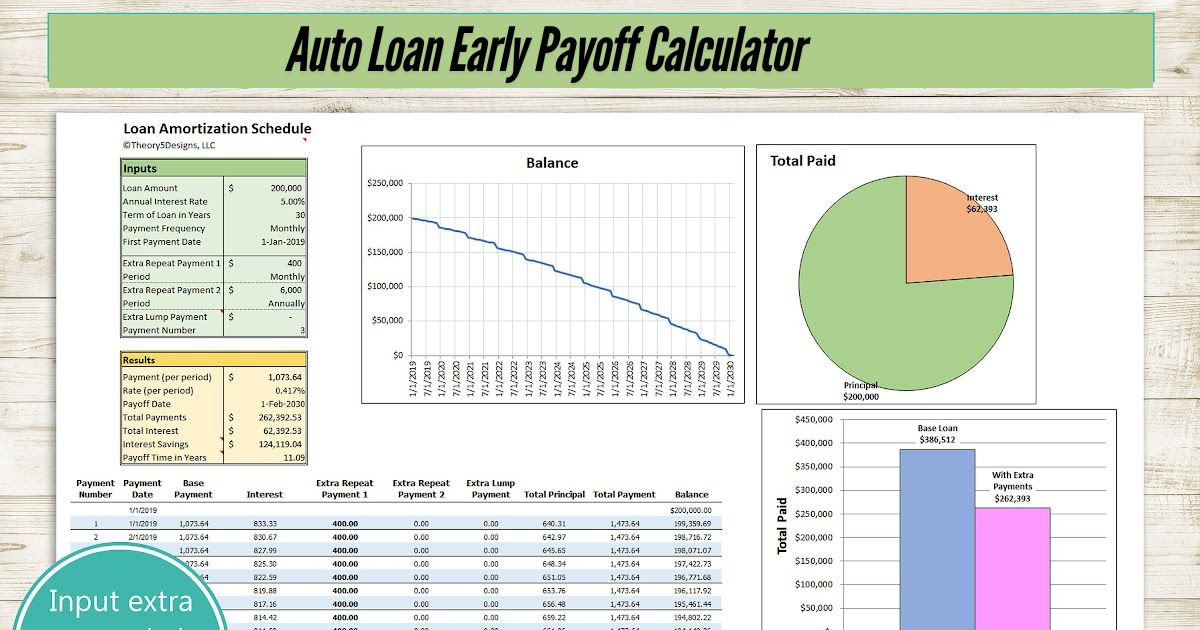

An auto loan early payoff calculator is an online tool that helps borrowers estimate how much they can save in interest by paying off their loan ahead of schedule. It provides:

- The adjusted loan payoff amount.

- Potential savings in interest.

- Revised payment schedules.

These calculators factor in your loan balance, interest rate, and remaining term, giving a clear picture of your financial options.

Key Features:

- Customizable inputs (current balance, extra payment amounts).

- Detailed amortization schedules.

- Interest savings breakdown.

Why Should You Consider Early Loan Payoff?

Paying off your auto loan early has significant benefits, including:

- Interest Savings: Reducing the time you’re paying interest means more money stays in your pocket.

- Debt Freedom: Eliminating your loan creates financial breathing room for future goals.

- Improved Credit Score: Lower debt can positively impact your credit utilization ratio.

- Peace of Mind: Owning your car outright eliminates monthly obligations.

Actionable Tips for Early Auto Loan Payoff

Here are practical strategies to pay off your loan faster:

- Round Up Payments: Add extra amounts to each monthly payment.

- Make Bi-Weekly Payments: Split your monthly payment in half and pay every two weeks to make one extra payment annually.

- Use Windfalls: Apply bonuses or tax refunds toward your loan.

- Cut Back on Expenses: Redirect savings from lifestyle adjustments to your loan.

- Avoid Prepayment Penalties: Check your loan terms to ensure there are no extra fees for early payoff.

Case Study: Jane had a $20,000 loan with a 5% interest rate and a 60-month term. By rounding up her $377 monthly payment to $400, she saved $450 in interest and paid off her loan 5 months early.

Advantages of Using an Auto Loan Early Payoff Calculator

An auto loan early payoff calculator simplifies decision-making by:

- Visualizing Savings: See the direct impact of extra payments.

- Tracking Progress: Stay motivated with clear milestones.

- Avoiding Surprises: Understand total payoff amounts.

| Feature | Advantage |

|---|---|

| Interest Savings Breakdown | Identifies potential savings accurately. |

| Flexible Inputs | Adjust scenarios to fit your financial situation. |

| Amortization Schedule | Provides detailed payment timelines. |

Comparing Early Payoff Scenarios

| Scenario | Monthly Payment | Interest Paid | Loan Term |

| Standard Payments | $377 | $2,645 | 60 months |

| Round-Up Strategy ($400/mo) | $400 | $2,195 | 55 months |

| Bi-Weekly Payments | $188 (bi-weekly) | $2,095 | 54 months |

User Experience: Simplifying Your Journey

Using an auto loan early payoff calculator is straightforward. Follow these steps:

- Input Loan Details: Enter your balance, interest rate, and remaining term.

- Add Extra Payments: Experiment with one-time or recurring extra payments.

- Analyze Results: Review savings and revised schedules.

Pro Tip: Bookmark your favorite calculator to revisit as your financial situation changes.

Common Questions About Early Payoff

1. Does paying off a car loan early hurt your credit? Not necessarily. While it may slightly impact your credit mix, the benefits of reduced debt often outweigh this.

2. Can I negotiate my loan payoff amount? Some lenders may offer discounts for lump-sum payments. Always ask.

3. Are there penalties for early payoff? Review your loan agreement for prepayment penalties, which some lenders impose.

Conclusion

Paying off your car loan early can unlock financial freedom and save you money. By using an auto loan early payoff calculator, you gain the clarity needed to make informed decisions. Whether you’re rounding up payments, using windfalls, or simply exploring your options, this tool is your gateway to smarter financial management.

Take Action: Start by using a calculator today. Share your success stories in the comments and inspire others on their journey toward financial freedom. Together, let’s create a debt-free future!

FAQs

1. How much can I save by paying off my car loan early? Your savings depend on your loan’s interest rate, remaining balance, and the size of your extra payments.

2. Are auto loan early payoff calculators free? Yes, most online calculators are free and user-friendly.

3. What’s the best strategy for early loan payoff? Combining biweekly payments and windfalls often yields the best results.

4. Can I partially pay off my loan? Yes, partial payments reduce the principal and can save on interest.

5. Where can I find a reliable calculator? Check trusted financial websites or consult with your lender for recommendations.

Final Thoughts

Picture a future where your car belongs entirely to you, free from the burden of monthly payments. Imagine redirecting that money toward dreams like vacations, savings, or investments. This is not just about numbers; it’s about reclaiming control over your finances and building a brighter future.

Start your journey now by using an auto loan early payoff calculator. Share this article with friends and family who might benefit, and let’s inspire a movement toward financial freedom!

For more exciting details over this topic, please visit our site: internetverizons.com