If you’re looking to pay off your auto loan early or simply want to track your progress, an auto loan payoff calculator can be an invaluable tool. Understanding how it works and how it can help you manage your finances effectively is crucial to getting ahead on your loan payments. In this article, we’ll dive deep into how an auto loan payoff calculator works, its benefits, and how to use it to reduce your debt faster.

What is an Auto Loan Payoff Calculator?

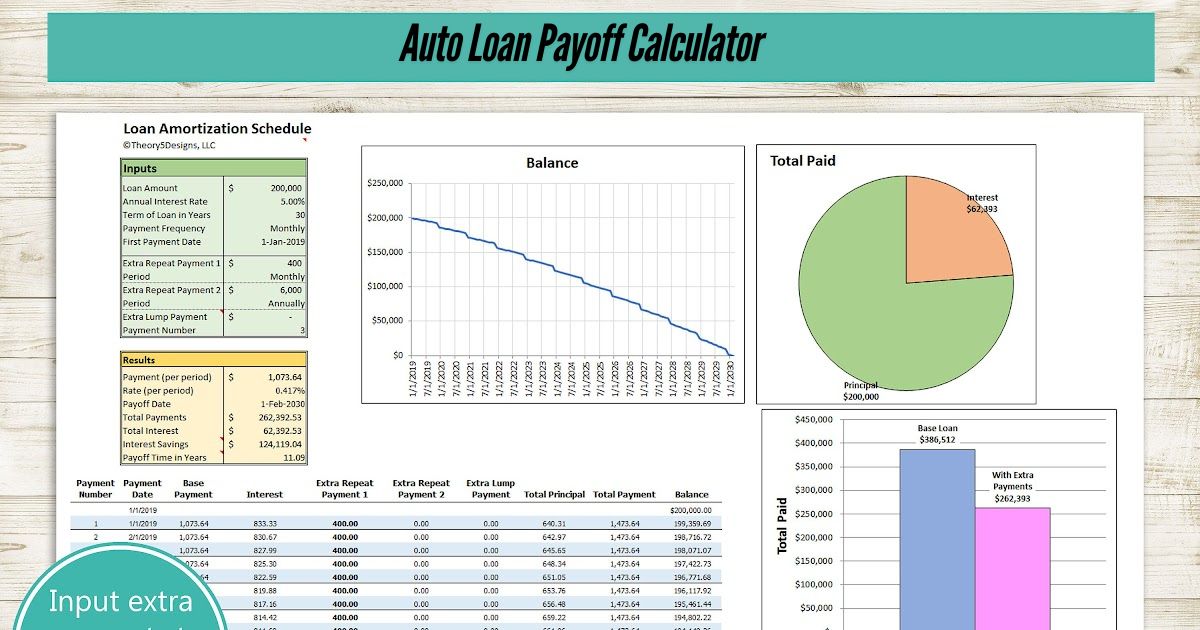

An auto loan payoff calculator is a tool that helps you estimate how long it will take to pay off your loan based on your current payments, the interest rate, and the remaining balance. It also lets you experiment with different payment amounts, showing you how paying extra or adjusting your terms can impact your loan’s life.

Whether you have an existing auto loan or are considering taking one out, this tool can give you a clearer picture of your financial situation and help you make informed decisions about your payments.

Why Should You Use an Auto Loan Payoff Calculator?

1. See the Big Picture: An auto loan payoff calculator provides a clear and concise view of your loan’s progress, letting you visualize when you’ll be free from debt. With this tool, you can track how much interest you’re paying and how your loan balance decreases over time.

2. Pay Off Your Loan Faster: By experimenting with higher payments or making extra payments, you can accelerate your loan payoff. The calculator shows you the impact of these adjustments, helping you understand how much interest you could save by paying off your loan earlier than planned.

3. Stay on Track with Your Budget: Knowing exactly how much you owe and when you will be debt-free can help you manage your finances. You can plan your budget accordingly and avoid any financial surprises, giving you peace of mind.

4. Save Money on Interest: The more frequently you make larger payments, the less interest you’ll end up paying over the life of the loan. The calculator can show you how paying an extra $50 or $100 a month will reduce your interest payments.

How Does an Auto Loan Payoff Calculator Work?

An auto loan payoff calculator works by considering the following key factors:

- Loan Balance: The remaining amount you owe on your loan.

- Interest Rate: The rate at which your loan accrues interest.

- Monthly Payment: The fixed or variable amount you pay each month.

- Loan Term: The period over which you agreed to repay the loan (usually measured in months or years).

Example Calculation

Let’s say you have a car loan of $10,000 at an interest rate of 5% with a loan term of 5 years (60 months). Your monthly payment is $188.71. Using an auto loan payoff calculator, you can adjust the figures to see the following:

- If you make extra monthly payments, you might pay off your loan in 48 months, saving interest.

- If you decide to make a lump sum payment, you can see how much the principal balance drops and how much interest you’ll save over time.

Tips for Using an Auto Loan Payoff Calculator

1. Try Paying Extra Each Month: The most effective way to pay off your loan faster and reduce interest is by adding a little extra to your monthly payments. The calculator will show you how an extra $50 or $100 could make a significant difference in reducing your balance faster.

2. Round Up Your Payments: Even rounding up to the nearest $10 or $20 can help you pay off your loan early. Over time, those small adjustments add up, and the payoff calculator can show you exactly how much faster you can become debt-free with small increments.

3. Lump Sum Payments: If you receive a tax refund, bonus, or any other windfall, you can enter it into the calculator as a one-time payment and see the immediate impact it will have on your loan balance and the overall interest paid.

4. Experiment with Loan Term Adjustments: If you can afford higher monthly payments, consider shortening your loan term. The payoff calculator will show you how this can reduce your interest significantly.

Benefits of Paying Off Your Auto Loan Early

1. Reduced Interest Payments: The biggest advantage of paying off your auto loan early is the reduction in interest. Most auto loans use simple interest, meaning the interest is calculated on the remaining balance. By paying it off faster, you reduce the balance, thus lowering the amount of interest you pay over time.

2. Increased Financial Freedom: Without an auto loan to pay off, you free up more of your monthly income, which can be used for savings, investments, or other financial goals.

3. Improved Credit Score: Paying off your auto loan on time or early can boost your credit score. A good credit score can help you secure better rates on future loans and credit cards.

Common Mistakes to Avoid When Using an Auto Loan Payoff Calculator

1. Not Including Fees: Make sure to account for any fees associated with early repayment, as some lenders charge prepayment penalties. This will help you get an accurate picture of how much you will save in the long run.

2. Overestimating Your Budget: While paying extra may seem like a good idea, make sure that you’re still within your financial means. Using the calculator helps you avoid overextending yourself and staying on track with your long-term financial goals.

3. Ignoring Loan Terms: Before making any changes, be sure to understand your loan agreement fully. Some loans may have restrictions on early repayment, or you may face penalties if you change your terms too frequently.

Conclusion: Take Control of Your Loan and Save Money

An auto loan payoff calculator is a powerful tool that can help you manage your auto loan effectively, save money on interest, and achieve your goal of becoming debt-free sooner. By understanding how the tool works and applying it to your loan strategy, you can make informed decisions that benefit your long-term financial health.

Start experimenting today with your numbers and see how small changes in your payments can have a big impact on your financial future. Whether you’re trying to pay off your car loan faster or simply manage your payments better, this calculator can be your guide to success.