In today’s fast-paced world, financial flexibility is more crucial than ever. Whether it’s an unexpected expense or a planned purchase, having quick access to funds can make all the difference. Enter the EnableLoans.com Login App—a platform designed to provide fast online personal cash loans up to $2,000.

But how does it work? Is it the right choice for you? Let’s delve into the details.

Key Takeaways:

- Quick Access to Funds: Apply for loans up to $2,000 directly through the app.

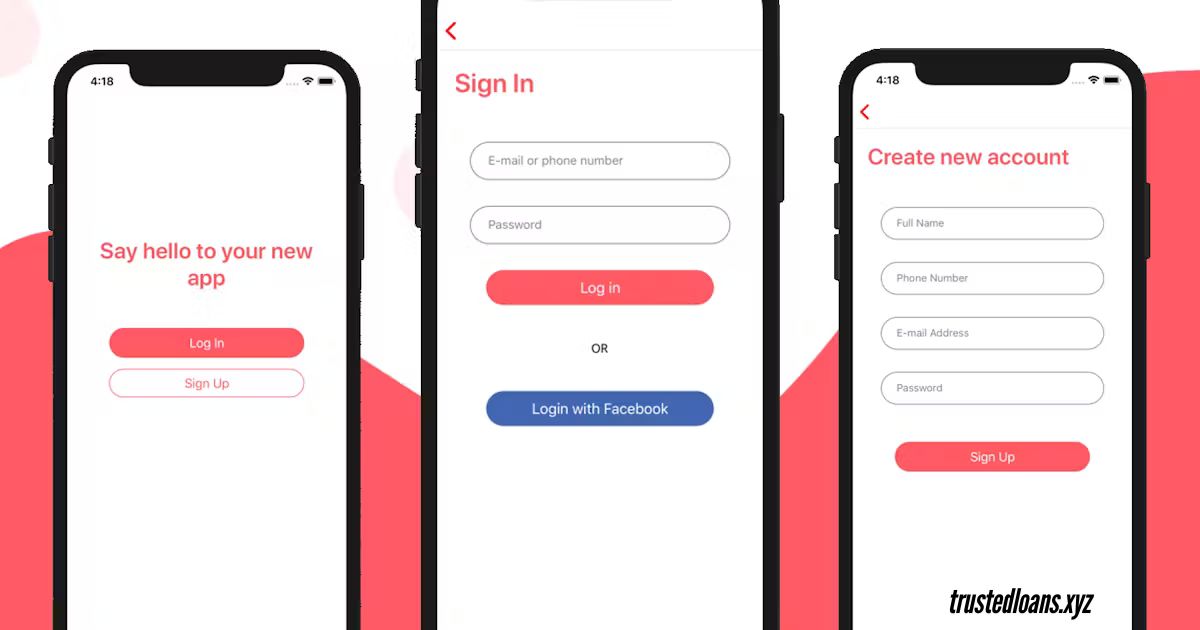

- User-Friendly Interface: navigate the application process with ease.

- Secure Transactions: Your personal and financial information is protected.

- Customer Support: Reach out via phone at (888) 704-3223 or email at info@enableloans.com.

Advantages of Using the EnableLoans.com Login App:

- Speed and convenience: Apply and receive funds without lengthy paperwork.

- Accessibility: Available to users across various locations.

- Transparency: Clear terms and conditions with no hidden fees.

- Customer Support: Dedicated team ready to assist you.

How to Get Started:

- Download the app: Available on major app stores.

- Create an Account: Provide necessary personal information.

- Apply for a Loan: Choose the amount and repayment terms.

- Receive Funds: Once approved, funds are deposited directly into your account.

Comparative Analysis:

| Feature | EnableLoans.com App | Competitor A | Competitor B |

|---|---|---|---|

| Loan Amount | Up to $2,000 | Up to $1,000 | Up to $2,000 |

| Repayment Terms | Flexible | Fixed | Flexible |

| Application Process | Online | In-Store | Online |

| Customer Support | 24/7 | Business Hours | 24/7 |

| Interest Rates | Competitive | High | Competitive |

User Experience:

Users have praised the EnableLoans.com Login App for its intuitive design and swift loan approval process. Many appreciate the flexibility in repayment options and the transparency of terms.

Actionable Tips:

- Assess Your Needs: Determine the exact amount you require before applying.

- Understand Repayment Terms: Ensure you can comfortably meet the repayment schedule.

- Maintain a Good Credit Score: This can influence your loan approval and terms.

Case Study:

Sarah’s Story:

Sarah, a freelance graphic designer, faced an unexpected medical expense. She turned to the EnableLoans.com Login App, applied for a $1,000 loan, and received the funds within hours. The flexible repayment terms allowed her to manage her finances without stress.

FAQs:

- Is the EnableLoans.com Login App available in my area?

- The app is accessible in various locations. Check the app store for availability.

- What are the eligibility criteria?

- Applicants must be at least 18 years old and have a steady income.

- How quickly can I receive funds?

- Once approved, funds are typically deposited within one business day.

- Are there any hidden fees?

- No, all fees are clearly outlined during the application process.

- Can I repay the loan early?

- Yes, early repayment is allowed without penalties.

Conclusion:

The EnableLoans.com Login App offers a streamlined solution for those in need of quick financial assistance. With its user-friendly interface, transparent terms, and dedicated customer support, it stands out as a reliable choice. Remember to assess your financial situation and ensure you can meet the repayment terms before applying.

Final Thoughts:

Financial challenges can be daunting, but with the right tools, they become manageable. The EnableLoans.com Login App is here to empower you, providing the support you need to navigate life’s unexpected turns. Take control of your financial journey today.

Note: This article is for informational purposes only. Always read and understand the terms and conditions before applying for any loan.